Our Process

Solve Your Business' Biggest Risk

Building a resilient business means first identifying the risks within it. From rising E-Mod to unhappy employees to subcontractor agreements – we help you pinpoint your risks, then solve for them piece by piece.

Week 1: Prioritize

You and other key decision-makers will sit down with us to determine what risks are most prevalent today.

Weeks 2-5: Evaluate

We assess and benchmark your most pressing impact area of risk, then get to work on your customized plan.

Weeks 6-12: Implement

We’ll walk through your plan together to ensure it meets your needs, then help implement your strategies.

Repeat

At the end of each quarter, you'll re-prioritize your business's risks and begin a new action plan.

We Help You...

Lower Your E-Mod

You don't lower your E-Mod by quoting insurance. You do it by strategically creating the culture that lends itself to safety and productivity. From toolbox talks to pre-employment screenings to return-to-work programs, begin lowering your E-Mod today.

Create a Successful Transition Plan

Everyone exits the business at some point – whether it's on your timeline or nature's. Do you have a perpetuation plan in place? Whether you're trying to maximize your valuation, create an ownership structure for your team, or sell the business to family, now is the time to start planning.

Make Insurance Carriers Compete for You

Insurance is about the story you tell. What are you doing to hire the right people, keep those people safe, protect yourself contractually, or continue operations in the event of a disaster? We can help you craft a narrative that makes you a top-of-stack submission to any insurance underwriter.

Risk Management Scenario

You own a carpet installation business and employ 12 full-time employees, plus you have a distributor and a couple subcontractors you work with regularly. With retirement on the horizon, you’ve had a couple projects go south with your subcontractors and your distributor is raising prices, putting your retirement plan on hold.

Your risk advisor brings together a team of experts to help you deploy a business perpetuation plan, shore up your contracts to shift accountability and negotiate better pricing, and puts a holistic risk management plan in place going forward to help you protect your purpose – your business, your life and your future.

Attract & Retain Your Best People

It's no secret that hiring quality craftsmen is not easy in this market. Set yourself apart – from your benefits package to leadership incentives to hiring practices to bring in the right cultural fits and to retain your top performing team members.

Protect Your Profits

At the end of the day, as a business owner, you're responsible for the risks in your organization. And every dollar spent on employee injuries, rising insurance costs, unexpected lawsuits or hiring and replacing employees comes out of your pocket. Start thinking long-term with risk management and start seeing the ROI.

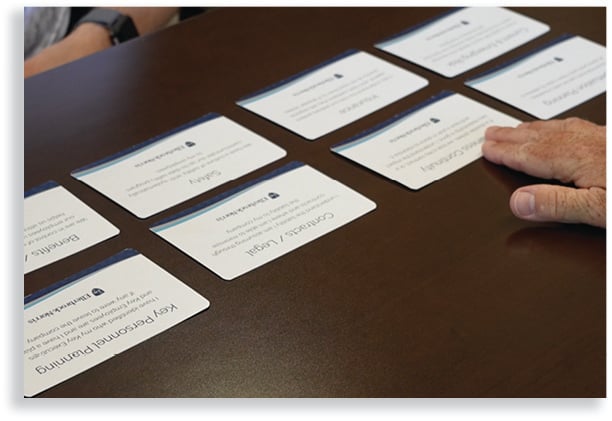

Our Areas of Expertise

Want to lower your E-Mod? We'll dive into safety, insurance and compliance. Need to retain your key people? Let's discuss that, plus employee ownership opportunities and employee retention. We look at 10 impact areas of your business to help you build resilience and protect your purpose.

Protect Your Purpose

Guidebook

See if Ellerbrock-Norris is a fit for your business with our 60-plus page guidebook on how we help you Protect Your Purpose.

Risk Management Scenario

You own a concrete company and employ a crew of 14. You're start to feel the weight of a growing company and know you need to stop working in the business and start working on the business.

You bring in your risk advisor to first help you design a structured plan for your key people to keep them there as you transition to a true CEO role. Then, you focus on hiring practices and employee retention to keep your culture strong. Finally, you decide to implement a safety program to keep everyone safe on site and help lower your overall insurance and Workers' Compensation costs.

In the end, you are protecting your purpose – your business and the people in it, your life outside the workplace, and your future retirement goals.

.png?height=200&name=Blog%20Image%20(13).png)

.png?height=200&name=Blog%20Image%20(10).png)