Risk Management for Contractors

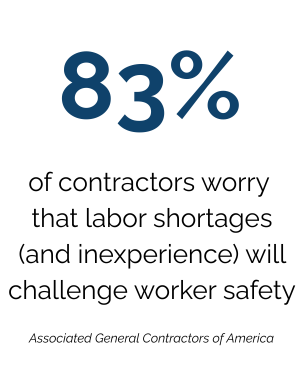

As a contractor, you're constantly facing risk, from the contracts binding you to subcontractors or clients to the day-to-day safety on the job. Not to mention the difficulty to find quality employees or knowing what happens to your business if something were to happen to you.

Risk management for contractors is about understanding what risks you face, then building a holistic plan to help maximize the value of your business.

We work with hundreds of contractors, from mid-sized developers to giant GCs, helping them understand the risks they face – even when they aren't glaringly apparent.

Start assessing the risks within your business today and maximize your valuation.

"The combination of risk management knowledge by the team in our specific business, along with the ENCORE plan are the main reasons we recommend Ellerbrock-Norris."

What's at Risk for Contractors?

Specialized Assessments

Know exactly where you stand across 10 impact areas of risks. We assess, measure and benchmark where you stand using our proprietary technology.

We Advise, You Decide

We are here to show you how to enhance your risk management strategy. You can execute on that advice by working with us, taking it in house, working with your current partners, or we can connect you with trusted third-party providers.

On-Site Safety Support

Our in-house safety consultants provide OSHA prep, jobsite walkthroughs, full-time or temporary staffing, plus training for your leadership and broader teams.

Contract Risk Guidance

We help you reduce liability by reviewing insurance requirements and providing guidance on subcontractor compliance – so gaps don’t come back to haunt you.

Tailored Coverage for Complex Projects

From general liability to builder’s risk, we design insurance programs that match your specific scope, scale and exposure so you're covered where it counts.

Maximize Your Value

Your business valuation matters today almost as much as it does when you decide to retire. Protect your valuation to protect your family, your legacy, and your employees. Start building your plan today.

Prioritize, Evaluate and Manage a New Risk Each Quarter

Deep dive the 10 impact areas of risk facing every trades business and put a plan in place today to help you protect and perpetuate your business.

Week 1: Prioritize

You and other key decision-makers will sit down with us to determine what risks are most prevalent today.

Weeks 2-5: Evaluate

We assess and benchmark your most pressing impact area of risk, then get to work on your customized plan.

Weeks 6-12: Implement

We’ll walk through your plan together to ensure it meets your needs, then help implement your strategies.

Repeat

At the end of each quarter, you'll re-prioritize your business's risks and begin a new action plan.

Risk Management Scenario

For the third year in a row, you see your Workers’ Compensation premium increase. You assumed this would happen after you had a few accidents that led to claims last year. However, you never expected your e-mod rate would be this high, and you know you must take action to fix it.

Rather than just quote a new insurance policy, which won’t help much on price, you call your risk advisor to see what safety programs and training is available in your industry. You decide to outsource the training, but implement the internal culture needed to reduce workplace accidents, including morning safety briefing and a “see something, say something” rule for all employees.