Self-funded health insurance is quickly becoming a go-to option for business owners tired of...

Level-Funded vs. Self-Funded Health Insurance: What's Best for Your Business?

Business owners face a daunting task when it comes to providing health insurance benefits for their employees.

With a plethora of options available – ranging from traditional coverage to level-funded health insurance and self-funded health insurance – it can be challenging to find the right fit.

Fully insured health insurance is the most popular option among smaller businesses. With a fully insured plan, your company pays a premium per employee to the insurance carrier and often passes some of the premium costs to the employee. This reduces your risk as a business owner, but also can be far more costly than level-funded or self-funded plans.

When a small business hits a certain size, usually around 30 employees, it is time to start exploring other health insurance plan types, which often leads to two options: level-funded vs. self-funded health insurance.

Deciding between the two can carry various advantages and disadvantages and finding the right fit is about understanding your business, your employees, and your long-term goals. We are here to help you do just that.

A third alternative to fully funded plans would be a captive insurance program, which pools your employees in with other similarly sized companies. This distributes risk evenly, which is an advantage, but it also distributes cost savings evenly. Meaning if you have a great claims year, your costs could still go up. For the sake of this article, we will leave captives out, but if you would like to explore this option in depth, feel free to make a call with us.

With that, let us dive into the key differentiators between level-funded and self-funded health insurance packages and what might be right for your company.

Why Offer Health Insurance at Your Business

Health insurance is crucial for businesses of any size. Having a strong benefits package attracts better talent and, most importantly, drastically improves retention among your current team members, which is one of the biggest risks facing business owners today.

Beyond recruiting and retention, group benefits also promote a healthier workforce, which can lead to reduced absences and provides financial protection for both the business and its employees in the face of unexpected medical expenses. A healthy workforce is a productive workforce.

Group benefits also save your employees money vs. the open market, leaving them with affordable options and reducing the financial strain – and often encouraging – doctor visits. For example, many plans make it free to the employee for their annual doctor visit, which could surface unknown health problems and alleviate problems before they become too serious.

Regardless of if you go level-funded health insurance or self-funded health insurance, group benefits packages have an extreme impact on the overall stability and success of your organization.

Level-Funded Health Insurance Plans

Level-funded health insurance plans balance the predictability of traditional fully insured health insurance with the potential cost savings of self-funded health insurance. Here is how they work:

- Fixed Monthly Premiums: With a level-funded plan, your small business pays a fixed monthly premium to the insurance carrier. This premium is typically lower than what you would pay for a fully insured plan because it covers only the expected healthcare costs for your employees.

- Claims Reconciliation: At the end of the year, the insurance carrier reviews the claims paid on behalf of your employees. If the claims are lower than the total premiums you paid, you may receive a refund or credit for the excess funds.

- Stop-Loss Insurance: To mitigate the risk of large claims exceeding your premium payments, level-funded plans often include stop-loss insurance. This insurance kicks in if your claims surpass a certain threshold.

Benefits of Level-Funding Plans for Small Businesses

The upsides of level-funding are:

- Cost Predictability: Small businesses can benefit from the predictability of fixed monthly premiums, making budgeting easier.

- Potential Cost Savings: If your employees' healthcare costs are lower than expected, you can receive a refund, providing potential cost savings.

- Customization: Level-funded plans can be customized to meet your company's specific needs, allowing you to choose from various coverage options.

- Claims Oversight: You receive more insights into your claims with a level-funded plan. Fully insured groups do not receive access to any claims data. There is a great advantage in receiving data when level-funded, and with that data, we can help identify cost-saving opportunities by tailoring your benefit package accordingly.

Disadvantages of Level-Funding Plans for Small Businesses

The downsides of level funding are:

- Risk of Higher Costs: If your employees' healthcare costs exceed expectations, you may receive a premium adjustment for the following year which could result in higher costs.

- Administrative Burden: There is added complexity when you have a level-funded plan. However, working with a TPA (Third Party Administrator) can reduce many of the administrative tasks. Still, it is important to understand level-funded plans are not as simple as fully insured plans.

Understanding Self-Funded Health Insurance Plans

Self-funded health insurance plans offer more control and flexibility to employers than fully insured insurance plans or level-funded insurance plans, but they can also add more risk than the alternatives. If you are looking at self-funded options, here is a quick look at what to expect:

- Customized Plans: You design your own health insurance plan, choosing benefit levels, cost-sharing arrangements and provider networks that work best for your situation.

- Funding Health Costs: Instead of paying fixed premiums to an insurance carrier, employers set aside funds to cover their employees' healthcare expenses. This can include paying claims directly or through a designated third-party administrator.

- Risk and Rewards: With self-funded plans, your business assumes the financial risk for employee healthcare costs. While this can lead to potential cost savings, it also means being responsible for covering all claims, which can be unpredictable.

- Stop-Loss Insurance: Employers often purchase stop-loss insurance to protect against catastrophic claims that exceed a predetermined threshold.

Benefits of Self-Funded Plans for Small Businesses

- Cost Transparency: Self-funded plans provide transparency into healthcare costs, enabling employers to see exactly where their healthcare dollars are going. This allows you to adjust your plan based on the needs of your employees.

- Cost Savings Potential: Small businesses that experience lower-than-expected claims can save significantly, as they retain any unused funds. Often, you will find self-funded plans accompanied by an employee wellness plan, which incentivizes employees to make healthy choices. The goal is to reduce claims and look out for employee wellbeing.

- Customization: Employers have full control over plan design, allowing you to tailor benefits to employee needs. If you know your prescription costs are high, you can look for a specific plan that helps with the specific drugs your employees need. If you have a lot of young families, you can pick a plan that offers great benefits for parents or soon-to-be parents.

- Control: Self-funding gives employers more control over plan administration, allowing for greater flexibility and responsiveness. Note that more control also leads to more complexity and administrative needs, which requires working alongside a benefits provider like Ellerbrock-Norris.

Disadvantages of Self-Funded Plans

- Financial Risk: The primary drawback of self-funded insurance plans is the financial risk. If your employees' healthcare costs are higher than expected, it can strain your company's profit. However, if you have a low claims year, you can find significant savings. You are looking at elevated risk and high reward.

- Complexity: Self-funded insurance plans require more administrative oversight, which can be challenging for small businesses with limited resources. We can help, but there is still added complexity at the employer level.

- Cash Flow Challenges: Smaller businesses may find it harder to manage cash flow fluctuations associated with a self-funded insurance plan. Your profit projections can take a hit with unexpected claims or higher prescription costs. Educating your executive team on the risks and rewards of the plan is key so they are not surprised on a down year.

How to Decide Between Level-Funded vs. Self-Funded Health Insurance Plans

The decision between level funded health insurance vs. self-funded health insurance plans depends completely on your business and your comfortability with risk. That's why it's so important to take in both the upside and the downside of level-funded health plans and self-funded health plans.

As you grow out of that fully insured plan type, here is what you should consider when evaluating level-funded health insurance vs. self-funded health insurance plans:

- Risk Tolerance: Consider your risk tolerance and financial stability. Level-funded plans offer more predictability, making them suitable for businesses that prefer a steady budget. Self-funded plans, on the other hand, offer potential cost savings but come with greater financial risk.

- Employee Size: Smaller businesses may find level-funded plans more accessible due to lower barriers to entry. Self-funded plans often require a critical mass of employees to spread risk effectively, along with proven cash flow to budget for unexpected costs.

- Administrative Resources: Assess your administrative capabilities. Self-funded plans require more hands-on management, so consider whether you have the resources to handle this aspect or prefer to delegate it to a third party with level-funded plans.

- Claims History: Review your employees’ claims history. If your team has low healthcare utilization, a self-funded plan might offer substantial savings.

- Budget Constraints: Evaluate your budget constraints. Level funded plans provide budgetary stability, making them a suitable choice for businesses with limited cash flow.

- Customization Needs: Consider the level of customization you require. Self-funded plans offer greater flexibility in plan design, allowing you to cater to specific employee needs.

- Consult with Experts: Do not hesitate to consult with insurance brokers, benefits consultants, or financial advisors who can provide valuable insights into level-funded vs. self-funded health insurance policies based on your unique circumstances.

Choosing the Right Plan for Your Small Business

Choosing between level-funded health insurance vs. self-funded health insurance options for your business is a critical decision that requires careful consideration. It is also important to review your coverage when making this decision.

Here are key factors to weigh when making this choice:

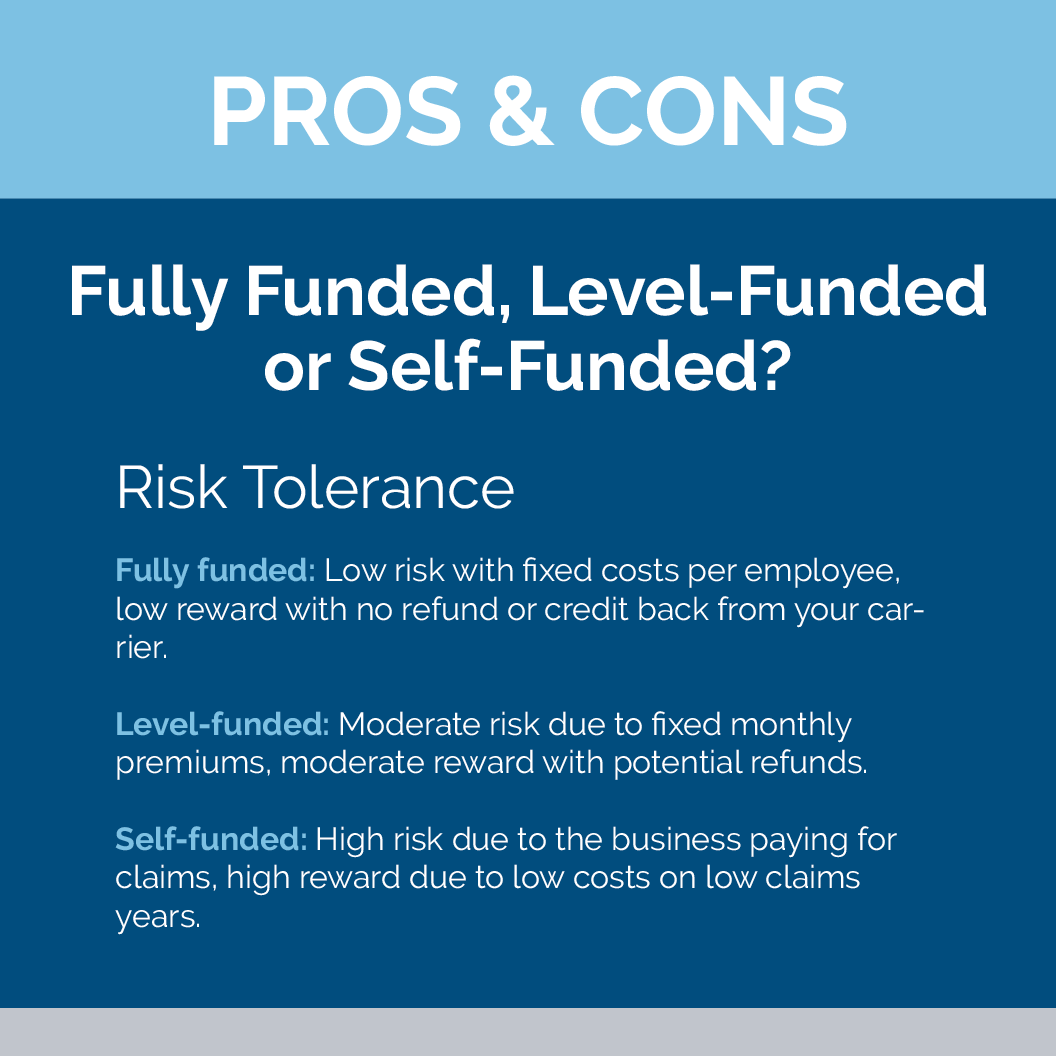

Risk Tolerance:

- Fully Insured: Minimal risk with fixed costs per employee, low reward with no refund or credit back from your carrier.

- Level funded: Moderate risk due to fixed monthly premiums, moderate reward with potential refunds.

- Self-funded: Substantial risk due to the business paying for claims, high reward due to low costs on low claims years.

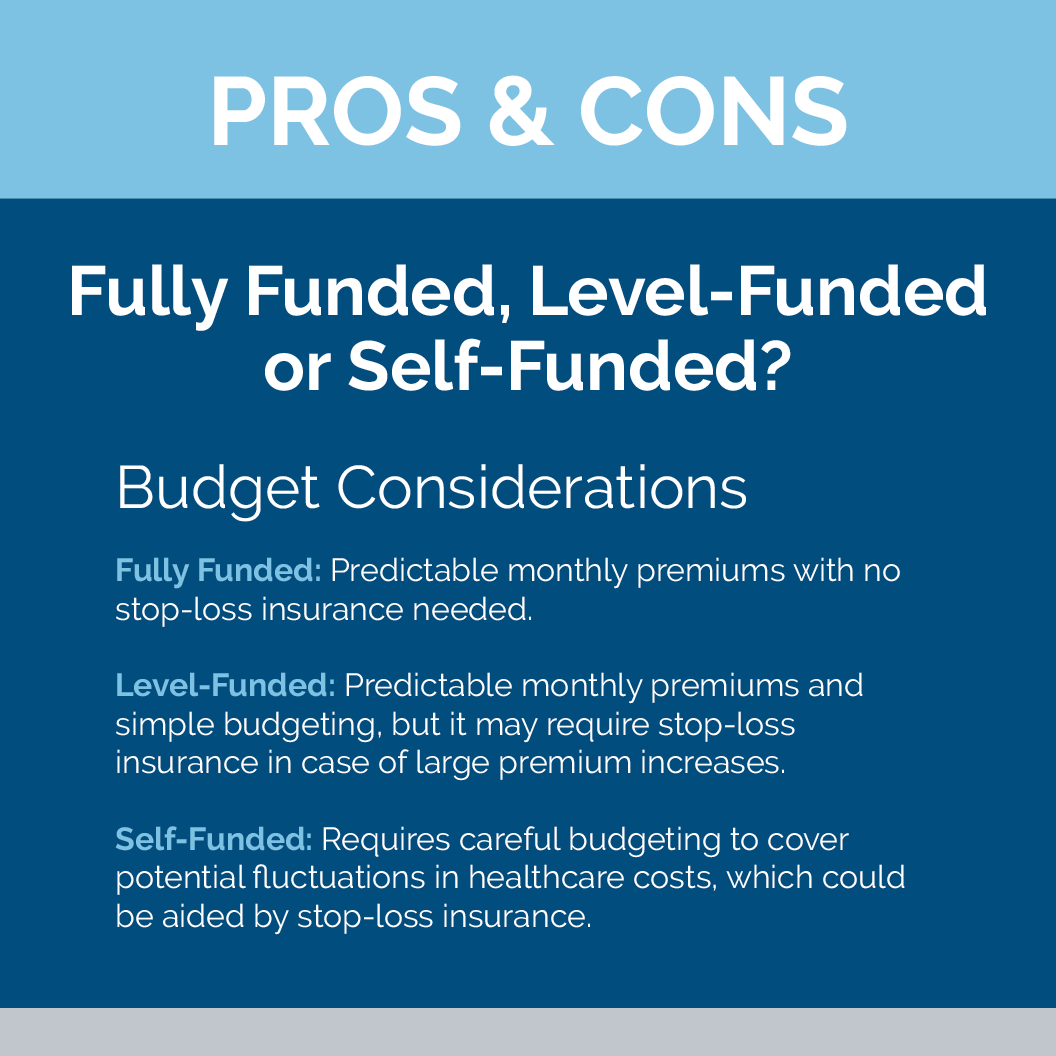

Budget Constraints:

- Fully Insured: Predictable monthly premiums with no stop-loss insurance needed.

- Level-funded: Predictable monthly premiums and simple budgeting, but it may require stop-loss insurance in case of large premium increases.

- Self-funded: Requires careful budgeting to cover potential fluctuations in healthcare costs, which could be aided by stop-loss insurance.

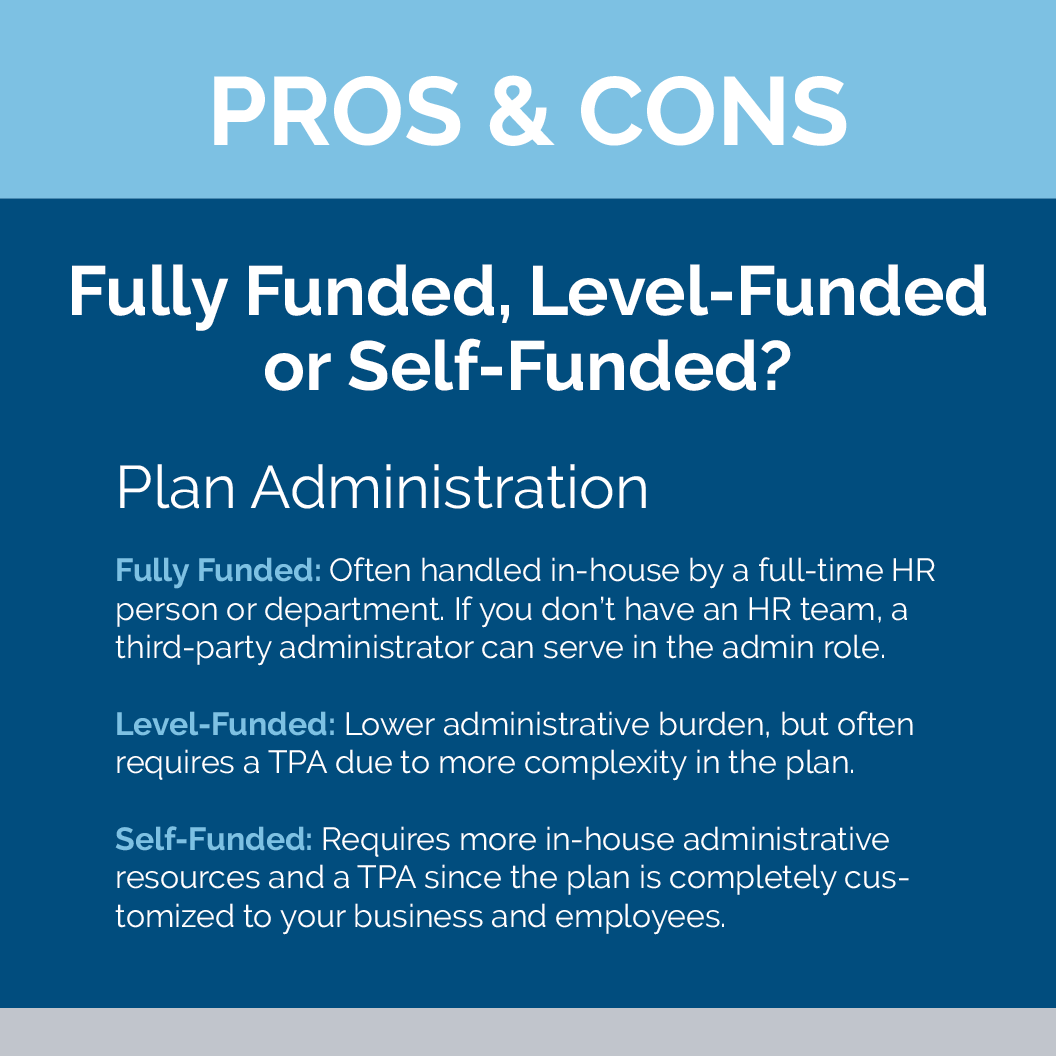

Administrative Resources:

- Fully Insured: Often handled in-house by a full-time human resources person or department. If you do not have an HR team, a third-party administrator can serve in the admin role.

- Level-funded: Lower administrative burden, but often requires a third party due to more complexity in the plan.

- Self-funded: Requires more in-house administrative resources and a TPA since the plan is completely customized to your business and employees.

The decision to move out of a fully funded plan, you are left to decide between level-funded vs. self-funded health insurance. The decision often hinges on your business' risk tolerance, financial resources, administrative capacity, and employee needs.

Careful evaluation of these factors will help you choose the option that aligns best with your business's objectives and employee well-being.

The Bottom Line

Choosing between level-funded vs. self-funded health insurance plans for your small business is a crucial decision.

Level-funded plans offer predictability and potential cost savings, while self-funded plans provide greater customization and control but come with higher financial risk.

Assess your business's financial situation, risk tolerance and administrative capabilities to make the right choice for your employees' healthcare needs. Consulting with experts can also help you navigate the complex world of health insurance and ensure you make an informed decision that benefits both your business and your employees.

In the end, the goal is to provide quality healthcare coverage for your employees while maintaining the financial health of your business. Whichever option you choose, regular review and adjustment of your healthcare strategy can help ensure you are meeting both objectives effectively.

.png?height=200&name=Lunch%20%26%20Legacy%20(1).png)